Tag Archive: stimulus

GDP Red Flag

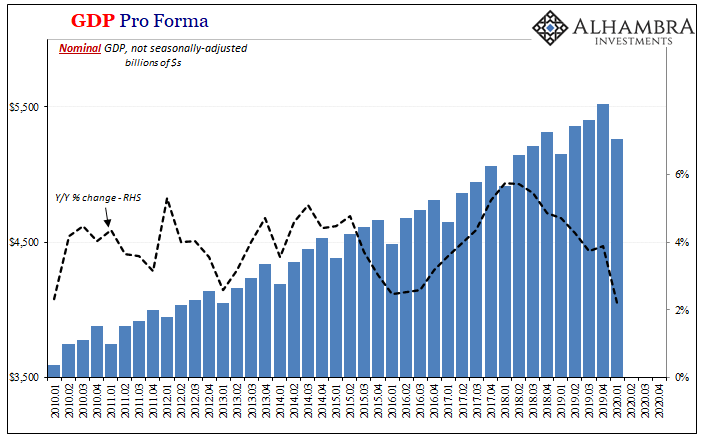

There were no surprises in today’s US GDP data. As expected, output sharply decelerated, modestly missing much-reduced expectations. The continuously compounded annual rate of change for Q3 2021 compared to Q2 was the tiniest bit less than 2% (1.99591%) given most recent expectations had been closer to 3%.

Read More »

Read More »

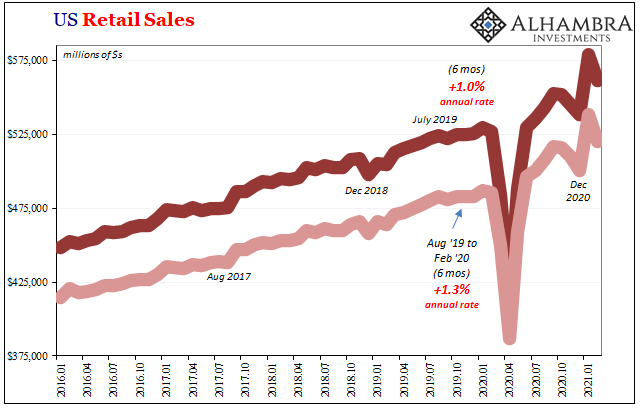

Spending Here, Production There, and What Autos Have To Do With It

While the global inflation picture remains fixed at firmly normal (as in, disinflationary), US retail sales by contrast have been highly abnormal. You’d think given that, the consumer price part of the economic equation would, well, equate eventually price-wise.

Read More »

Read More »

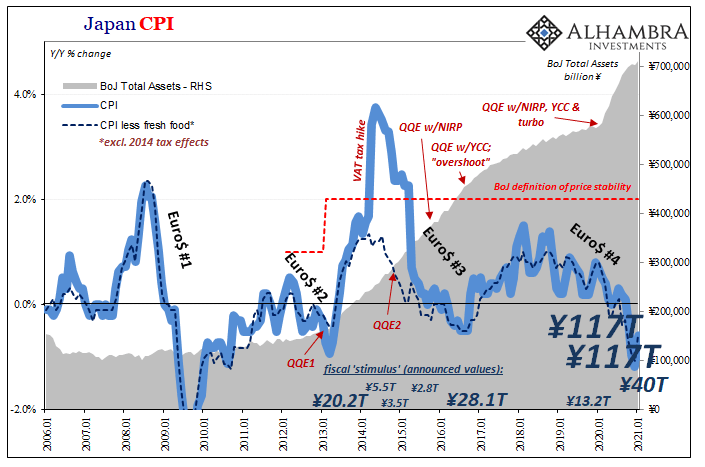

Nine Percent of GDP Fiscal, Ha! Try Forty

Fear of the ultra-inflationary aspects of fiscal overdrive. This is the current message, but according to what basis? Bigger is better, therefore if the last one didn’t work then the much larger next one absolutely will. So long as you forget there was a last one and when that prior version had been announced it was also given the same benefit of the doubt.

Read More »

Read More »

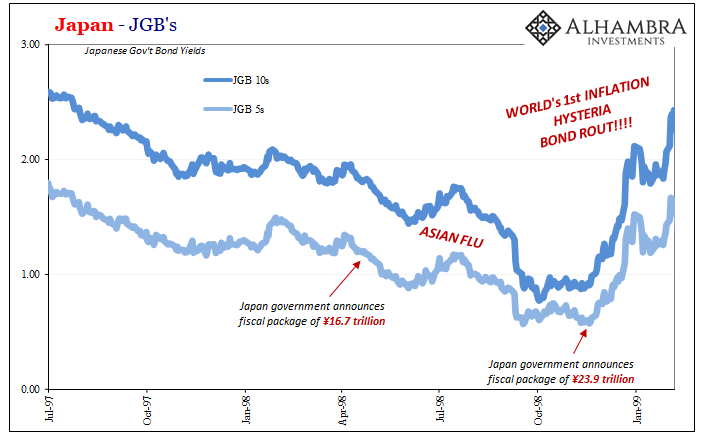

They’ve Gone Too Far (or have they?)

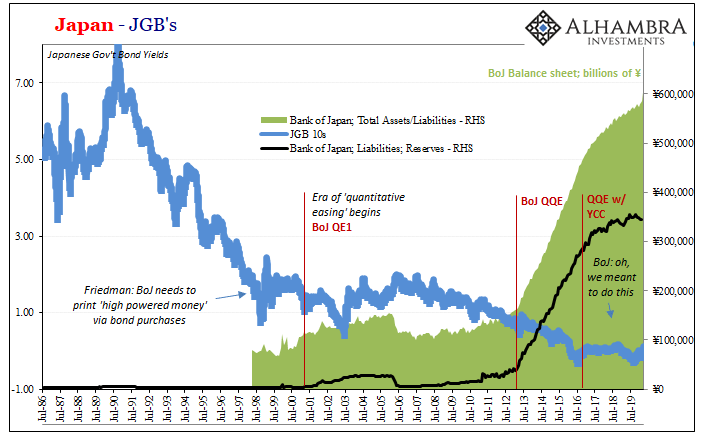

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months.

Read More »

Read More »

There’s Always A First Time

Is it a race against time? Or is it trying to set aside today so as to focus entirely on a specific kind of tomorrow? It’s easy to do the latter especially when today is what it is; you can’t change what’s already gone on.

Read More »

Read More »

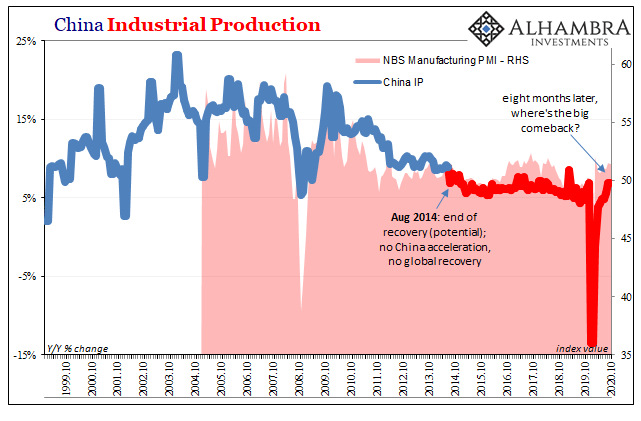

Six Point Nine Times Two Equals What It Had In Twenty Fourteen

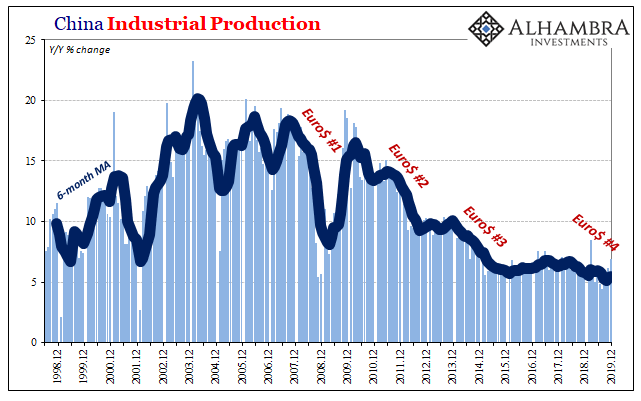

It was a shock, total disbelief given how everyone, and I mean everyone, had penciled China in as the world’s go-to growth engine. If the global economy was ever going to get off the ground again following GFC1 more than a half a decade before, the Chinese had to get back to their precrisis “normal.”

Read More »

Read More »

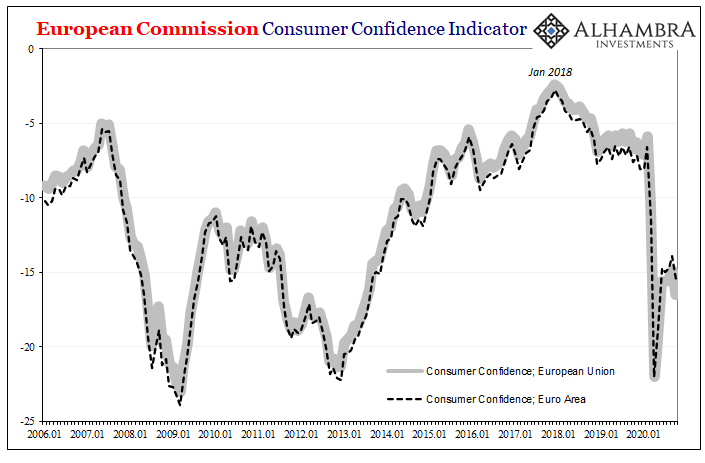

Consumer Confidence Indicator: Anesthesia

Europeans are growing more downbeat again. While ostensibly many are more worried about a new set of restrictions due to (even more overreactions about) COVID, that’s only part of the problem. The bigger factor, economically speaking, is that Europe’s economy has barely moved, or at most not moved near enough, off the bottom.

Read More »

Read More »

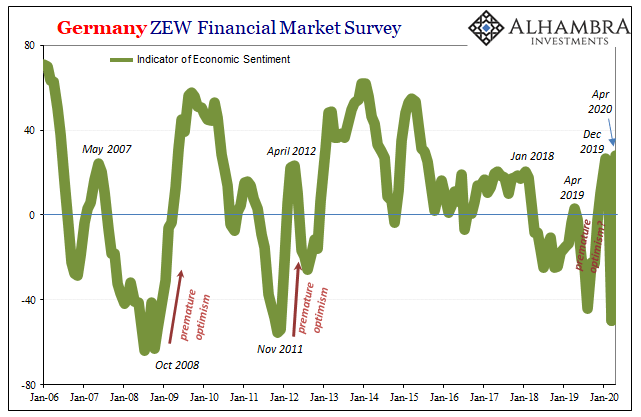

Science of Sentiment: Zooming Expectations Wonder

It had been an unusually heated gathering, one marked by temper tantrums and often publicly expressed rancor. Slamming tables, undiplomatic rudeness. Europe’s leaders had been brought together by the uncomfortable even dangerous fact that the economic dislocation they’ve put their countries through is going to sustain enormously negative pressures all throughout them. What would a “united” European system do to try and fill in this massive hole?The...

Read More »

Read More »

A Second JOLTS

What happens when we are stunned and dazed? We filter out the noise to focus on the bare basics by getting back to our instincts, acting reflexively based upon our deeply held beliefs and especially training. When faced with a crisis and there’s no time to really think, shorthand will have to suffice.

Read More »

Read More »

Of Incomplete Plans and Recoveries

At the monthly press conference China’s National Bureau of Statistics (NBS) now regularly gives whenever the Big Three economic accounts are updated (this time along with quarterly GDP), spokesman Liu Aihua was asked by a reporter from Reuters to comment on how the global economic recession might impact the Communist government’s long range goal of reaching its assigned GDP target.

Read More »

Read More »

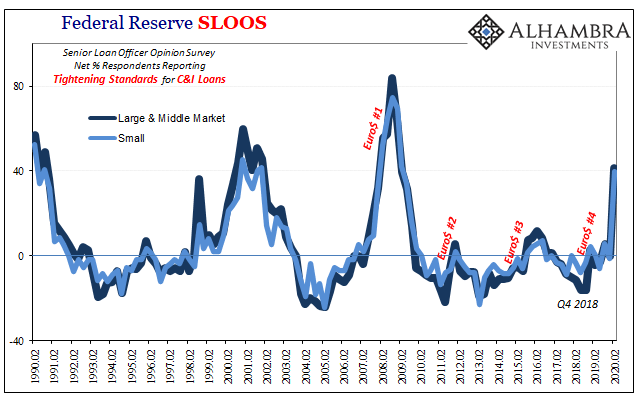

Not COVID-19, Watch For The Second Wave of GFC2

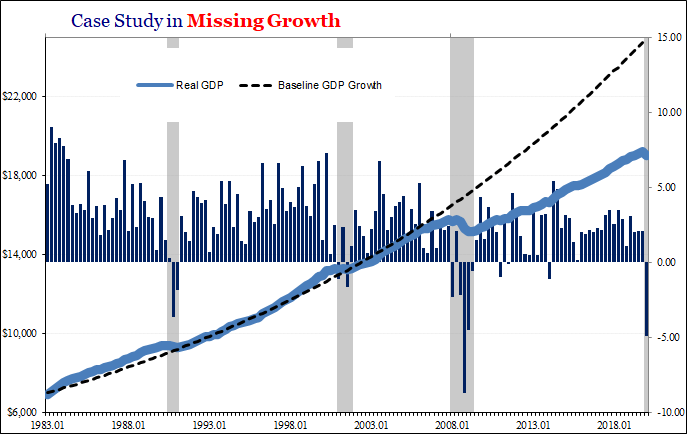

I guess in some ways it’s a race against the clock. What the optimists are really saying is the equivalent of the old eighties neo-Keynesian notion of filling in the troughs. That’s what government spending and monetary “stimulus” intend to accomplish, to limit the downside in a bid to buy time. Time for what? The economy to heal on its own.

Read More »

Read More »

This Thing Is Only Getting Started; Or, *All* The V’s Are Light On The Right

The Federal Reserve’s models really are the most optimistic of the bunch. With the policy meeting conducted today, no surprises as far as policies go, we now know what ferbus has to say about everything that’s happened this year. Skipping the usual March projections, what with the FOMC totally occupied at the time by a complete global monetary meltdown Jay Powell now says “we saw it coming”, the central bank staff released the calculations...

Read More »

Read More »

From QE to Eternity: The Backdoor Yield Caps

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and...

Read More »

Read More »

Getting A Sense of the Economy’s Current Hole and How the Government’s Measures To Fill It (Don’t) Add Up

The numbers just don’t add up. Even if you treat this stuff on the most charitable of terms, dollar for dollar, way too much of the hole almost certainly remains unfilled. That’s the thing about “stimulus” talk; for one thing, people seem to be viewing it as some kind of addition without thinking it all the way through first.You have to begin by sizing up the gross economic deficit it is being haphazardly poured into – with an additional emphasis...

Read More »

Read More »

GDP + GFC = Fragile

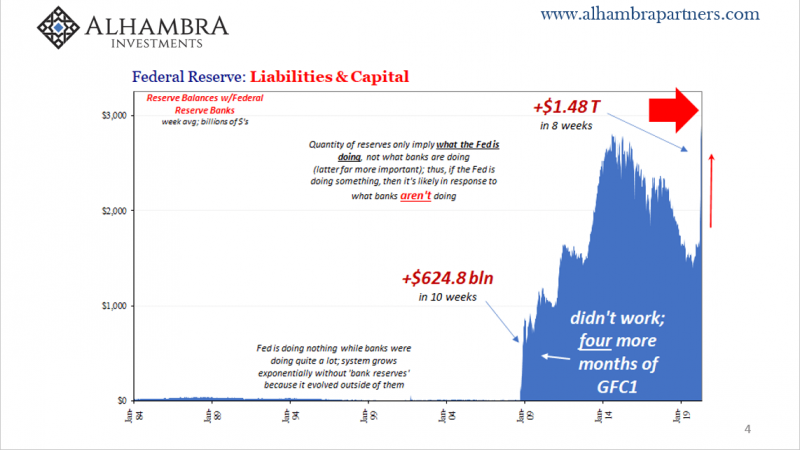

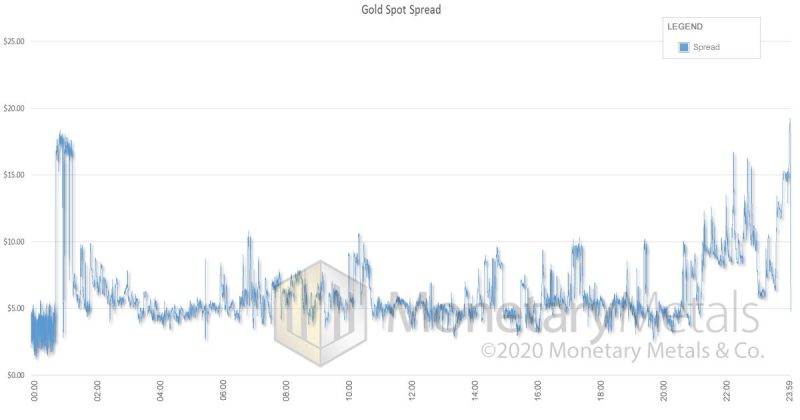

March 15 was when it all began to come down. Not the stock market; that had been in freefall already, beset by the rolling destruction of fire sale liquidations emanating out of the repo market (collateral side first). No matter what the Federal Reserve did or announced, there was no stopping the runaway devastation.

Read More »

Read More »

COT Black: No Love For Super-Secret Models

As I’ve said, it is a threefold failure of statistical models. The first being those which showed the economy was in good to great shape at the start of this thing. Widely used and even more widely cited, thanks to Jay Powell and his 2019 rate cuts plus “repo” operations the calculations suggested the system was robust.

Read More »

Read More »

The Greenspan Bell

What set me off down the rabbit hole trying to chase modern money’s proliferation of products originally was the distinct lack of curiosity on the subject. This was the nineties, after all, where economic growth grew on trees. Reportedly. Why on Earth would anyone purposefully go looking for the tiniest cracks in the dam?

Read More »

Read More »

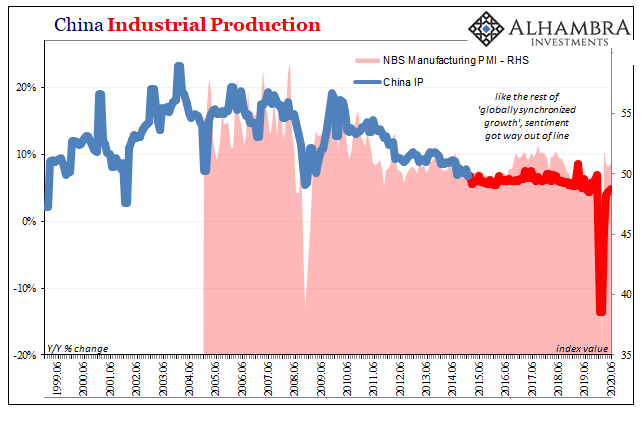

China Enters 2020 Still (Intent On) Managing Its Decline

Chinese Industrial Production accelerated further in December 2019, rising 6.9% year-over-year according to today’s estimates from China’s National Bureau of Statistics (NBS). That was a full percentage point above consensus. IP had bottomed out right in August at a record low 4.4%, and then, just as this wave of renewed optimism swept the world, it has rebounded alongside it.

Read More »

Read More »