Tag Archive: stagflation

Trees and the Forest

The Pando (pictured here) appears to be 107 acres of forest, but scientists have concluded that the nearly 47,000 genetically identical quaking aspen trees share a common root system.

Read More »

Read More »

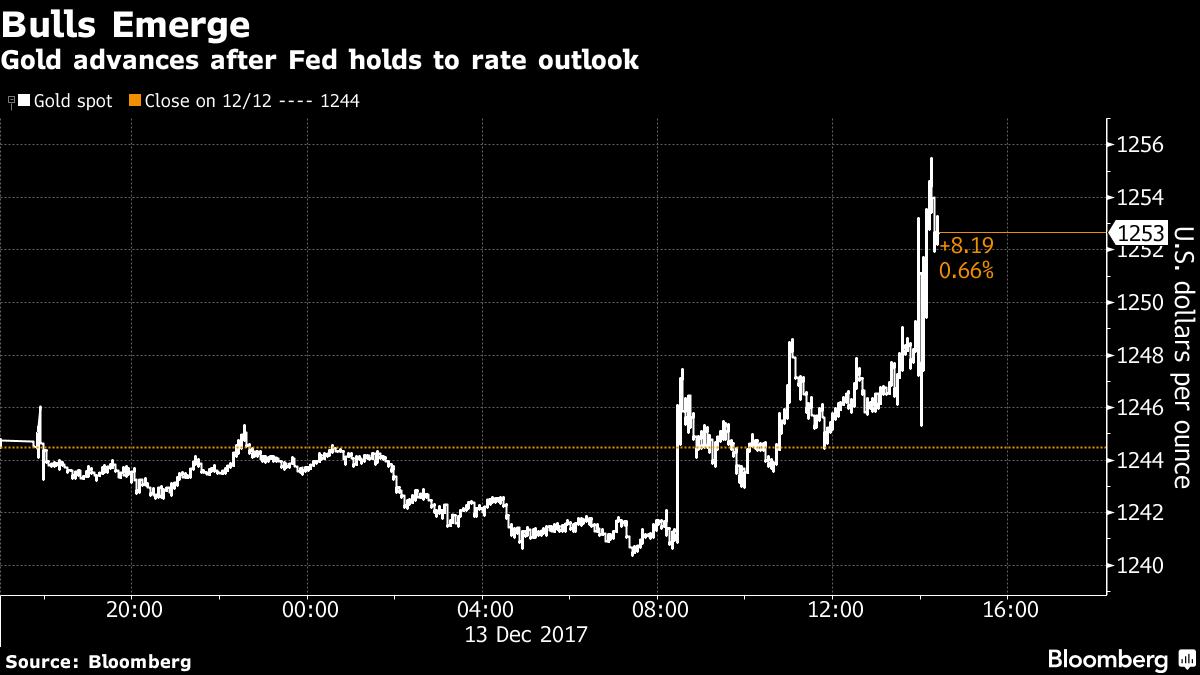

Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

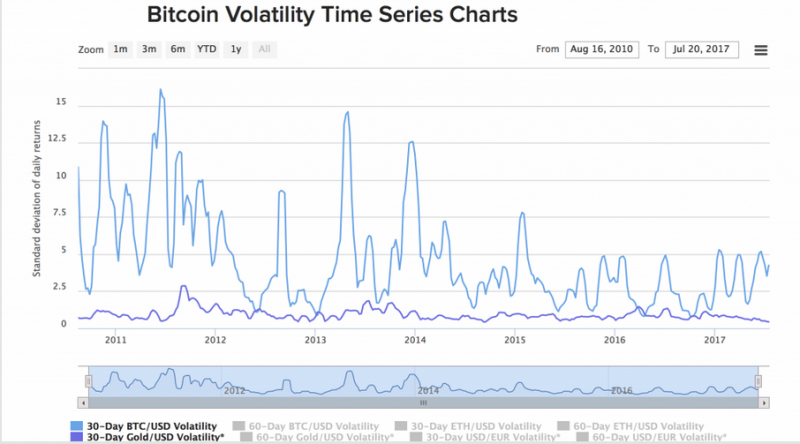

Year-end rate hike once again proves to be launchpad for gold price. FOMC follows through on much anticipated rate-hike of 0.25%. Spot gold responds by heading for biggest gain in three weeks, rising by over 1%. Final meeting for Federal Reserve Chair Janet Yellen. Yellen does not expect Trump's tax-cut package to result in significant, strong growth for US economy. No concern for bitcoin which 'plays a very small role in the payment system'.

Read More »

Read More »

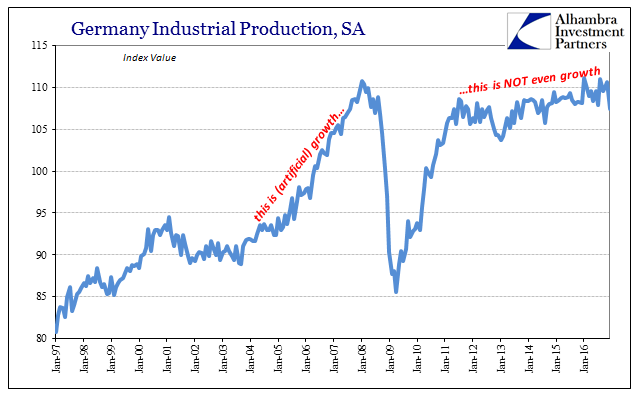

Economic Dissonance, Too

Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony.

Read More »

Read More »

WTI Crude tumbles To $49 Handle, Erases OPEC/NOPEC Deal Gains

But, but, but... growth, and inflation, and supply cuts, and growth again... Well that de-escalated quickly... As Libya restarts exports and The Fed sends the dollar soaring so WTI crude prices just broke back to a $49 handle for the first time since Dec 8th.

Read More »

Read More »

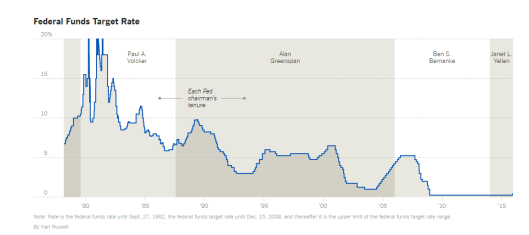

Greenspan explains negative Swiss Yields

For Alan Greenspan, negative Yield Reflect Spread between Italian and Swiss Bonds. For him, bond prices in general have risen too much.

Read More »

Read More »

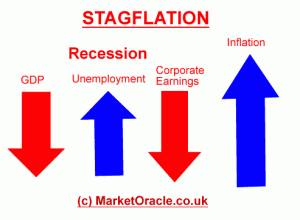

Volckers Attack on Stagflation

In this chapter we describe how Volcker managed to defeat stagflation; he applied the monetarist models that had been applied successfully in Switzerland and Germany. Thanks to this effort, the dollar stopped its secular decline.

Read More »

Read More »

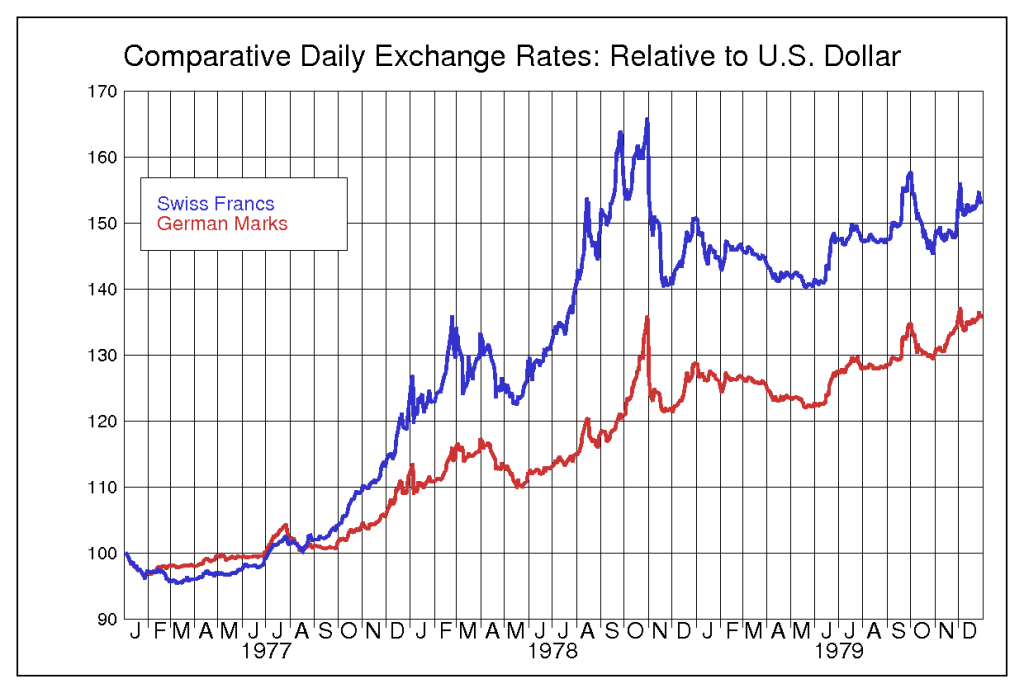

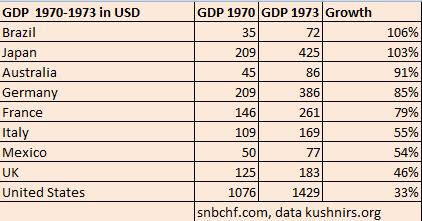

Swiss Franc History, 1970s: Due to US Stagflation CHF Strengthens Massively

We shows the massive appreciation of Swiss franc and German mark in the 1970s, the reasons were: stagflation and the wage-price spiral.

Read More »

Read More »

The “Cost-Push Inflation” Myth and the 1970s Stagflation

Economists commonly explain rising oil price between 1998 and 2008 with the growth of emerging markets. We argue that the cost-push inflation of the 1970s was also a reflection of rising global demand.

Read More »

Read More »

The Rise and Fall of Keynesian Economics

John Cassidy's remarkable interview with the Nobel Prize winner Paul Samuelson maybe best describes the rise and fall of Keynesian economics.

Keynesians led the world to two of its most unfortunate experiences, the 1970s stagflation and to the...

Read More »

Read More »

Euro Morons: Hyperinflation Successfully Avoided, Stagflation Successfully Created

Keeping Greece in euro zone, eurocrats or better “euro morons” have successfully avoided a weak drachma and a following Greek hyperinflation. Instead they successfully created stagflation. Currently European HICP inflation is at 2.5%, far above the max. 2.0% official ECB mandate, but the euro is becoming weaker and weaker. German salaries are rising with 2.6% …

Read More »

Read More »