Tag Archive: crypto

#1133 Bitcoin Fear & Greed, 43 Mio Bitcoin Hodler & Indian RBI Krypto Verbot

1.) Bitcoin steps out of ‚Fear‘ for the first time in nine monthsThe Bitcoin Fear and Greed Index reached an index score of 52 over the weekend, marking the first time its hit neutral territory in three quarters.

Read More »

Read More »

#1099 Stablecoin Krieg, Kraken Russland Sanktionen & Kazakhstan Mining

1.) A stablecoin’s rise in market share has ignited the ‘Second Great Stablecoin War’Since Binance announced it would auto-convert USDC, USDP and TUSD into BUSD on Sept. 6, BUSD’s share of the total stablecoin market has risen from 10.01% to 15.48%.

Read More »

Read More »

Fed Minutes were Not as Dovish as Initially Read

Overview: The sell-off in European bonds continues today. The 10-year German Bund yield is around four basis points higher to bring the three-day increase to about 22 bp. The Italian premium over Germany has risen by almost 18 bp over these three sessions.

Read More »

Read More »

Weekly Market Pulse: Expand Your Horizons

Late last year I wrote a weekly update that focused on the speculative nature of the markets. In that article, I focused on the S&P 500 because I wanted to make a point, namely that owning the S&P 500 did not absolve investment advisers of their fiduciary duty.

Read More »

Read More »

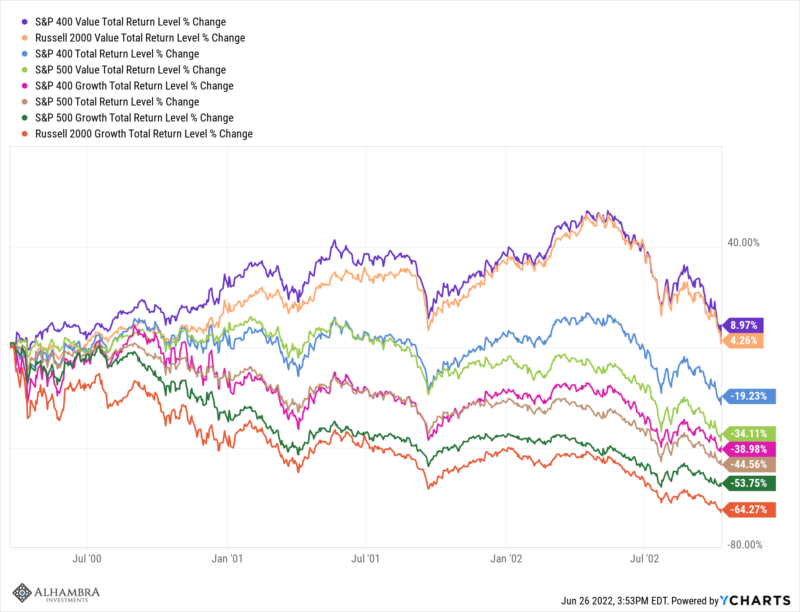

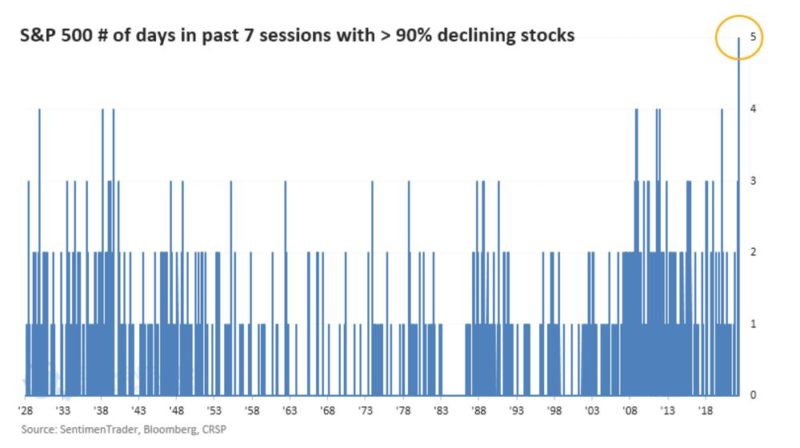

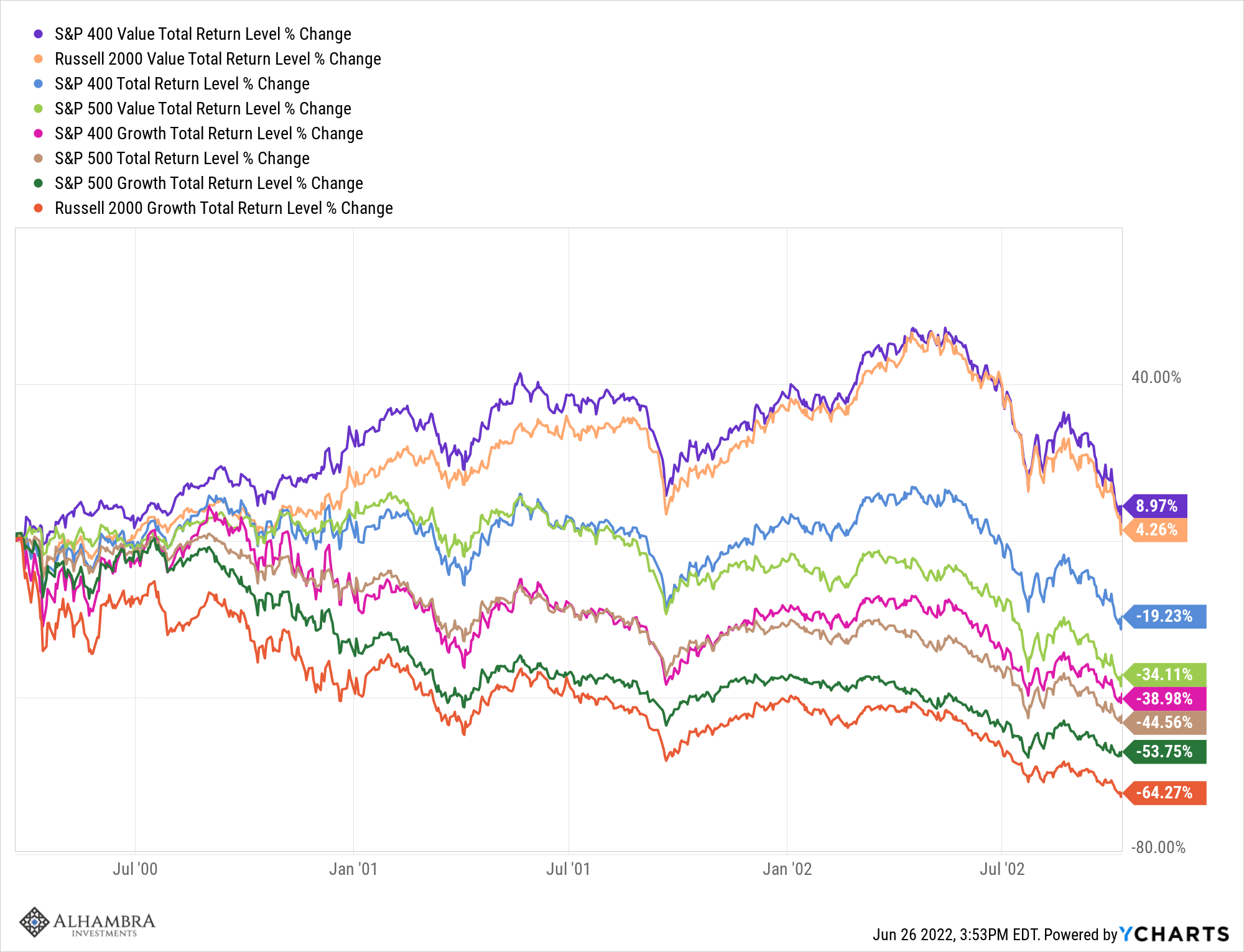

Market Pulse: Mid-Year Update

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets.

Read More »

Read More »

Markets Turn Cautious

Overview: After a couple of sessions of taking on more risk, investors are taking a break today. Equities are mostly lower today after the S&P 500's six-day advance took it almost to its record high, while the NASDAQ's streak was halted at five sessions.

Read More »

Read More »

The battle for control over the future of money

It’s no secret that governments and central planners of all stripes have long detested the rise of private money and independent digital currencies. They have tried to stifle the burgeoning crypto industry from the moment it attracted mainstream attention. For years, they have continued to add regulatory hurdles and threaten crypto holders and investors, as well as companies in this space, with unreasonable tax burdens and unrealistic disclosure...

Read More »

Read More »

FX Daily, May 24: China Action on Commodities and Crypto Featured

The US dollar is firmer in the European morning after starting out with a softer bias in Asia Pacific turnover. The dollar-bloc currencies, sterling, and the Swiss franc are heavy, but ranges are narrow, and consolidation seems to be the flavor of the day.

Read More »

Read More »

FX Daily, May 19: Now What Does Bitcoin say About the Dollar and the US?

A setback in commodities and technology are roiling equity markets today. The inability of US equities to sustain yesterday's rally provided an initial headwind to trading in the Asia Pacific region today. Hong Kong and South Korea markets were closed for holidays, but most of the bourses fell, led by Australia, where the market tumbled nearly 2%, the most in almost three months as the drop in mining and energy took a toll.

Read More »

Read More »

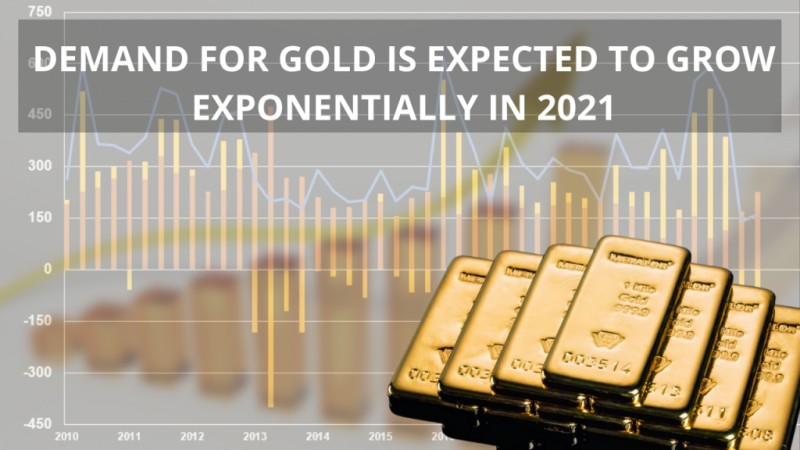

Demand for Gold is Expected to Grow Exponentially in 2021

The difference between physical gold investing and ETF investing was stark in the first quarter 2021 according to the World Gold Council’s Gold Demand Trends data released last week. Before focusing in on investment demand below a few notes on overall gold demand in the first quarter.

Read More »

Read More »

Marriage of Gold and Cryptocurrencies: A New Future?

The debate between relatively new digital cryptocurrencies versus ‘tried and true’ gold has dominated most precious metals related websites. But what if gold and cryptocurrencies were combined? According to a Bloomberg article a NYC Real Estate Mogul, after learning about cryptocurrencies from his son, is putting this concept to work by securing a minimum of $6 billion in gold reserves to back his new cryptocurrency.

Read More »

Read More »

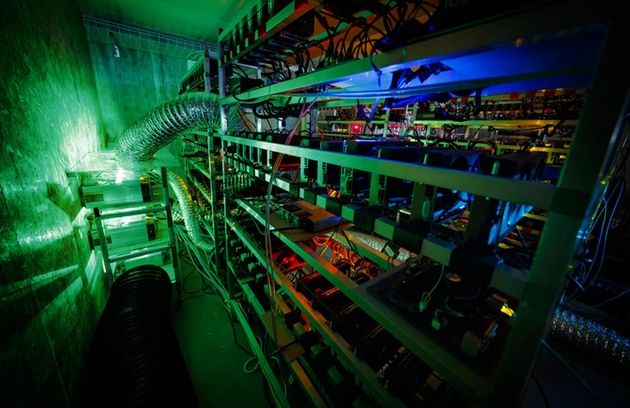

How crypto mining tried, but failed, to gain a Swiss toehold

There was a time when any Tom, Dick or Harry could create (or “mine”) bitcoin with a modified PC. Now only warehouses packed full of specialised computing gear stand any real chance. The bones of defunct crypto mines litter the Swiss Alps.

Read More »

Read More »

Is Gold Starting to Behave Itself?

2022-05-14

by Stephen Flood

2022-05-14

Read More »