Tag Archive: China

FX Daily, January 04: Rising Equities and Slumping Dollar Greet the New Year

Overview: The first day of the New Year, but it feels a lot like last year. The dollar is under pressure, and equities are higher. Outside of Japan and Malaysia, The MSCI Asia Pacific Index extended last week's 3.6% gain. It has not rallied for seven consecutive sessions.

Read More »

Read More »

The Dollar’s Evolving Outlook

The foreign exchange market sees an average daily turnover of something on the magnitude of $6.6 trillion a day. In a week, the turnover is sufficient to more than cover world trade for a year. It is the largest of the capital markets. Trends in the currency market can last for years.

Read More »

Read More »

FX Daily, December 17: Dollar Thumped

Overview: The prospects of a UK-EU deal and US stimulus continue to underwrite risk appetites and weigh on the dollar. Equity markets are moving higher. Led by Australia and China, the MSCI Asia Pacific Index rose to new record highs, while Dow Jones Stoxx 600 in Europe is at its best level since February.

Read More »

Read More »

This Global Growth Stuff, China Still Wants A Word

Before there could be “globally synchronized growth”, it had been plain old “global growth.” The former from 2017 appended the term “synchronized” to its latter 2014 forerunner in order to jazz it up. And it needed the additional rhetorical flourish due to the simple fact that in 2015 for all the stated promise of “global growth” it ended up meaning next to nothing in reality.Oddly the same for 2017’s update heading into 2018 and...

Read More »

Read More »

FX Daily, December 15: The Bulls are Emboldened

The S&P fell for the fourth consecutive session yesterday, the longest losing streak of the quarter, and this seemed to encourage profit-taking in the Asia Pacific region today. The MSCI Asia Pacific Index slipped for the second consecutive session, and even confirmation of the Chinese recovery failed to lift the Shanghai Composite.

Read More »

Read More »

FX Daily, December 14: Brexit Deal Hopes Lift Sterling

The fact that the UK and EU negotiators are still talking is seen as a constructive development and has spurred a sharp bounce in sterling. It traded below $1.3150 before the weekend and is pushing above $1.3400 in the European morning.

Read More »

Read More »

FX Daily, December 10: Brexit and US Stimulus are Unresolved as Attention Turns to the ECB

Overview: US threats to break-up Facebook and the stalled stimulus talks spurred profit-taking in US shares yesterday and is dampening enthusiasm today. The MSCI Asia Pacific Index fell for the third time this week, and Europe's Dow Jones Stoxx 600 is little changed.

Read More »

Read More »

FX Daily, December 9: Hope Burns Eternal

The market is hopeful today. The Johnson-von der Leyen dinner is seen as evidence that both sides see one more opportunity, and sterling is among the strongest currencies today. Hopes of a $900 bln+ fiscal stimulus package in the US helped stir animal spirits and lift US stocks to record highs yesterday.

Read More »

Read More »

FX Daily, December 2: Euro Rally Stalls while Brexit Concerns Trip Sterling

The selling pressure that drove the dollar lower yesterday has abated, and the greenback is paring yesterday's loss, though the dollar-bloc currencies are showing some resilience. EC negotiator Barnier briefed ministers that the same three issues that have bedeviled the trade talks with the UK remain unresolved (fisheries, level playing field, and a conflict resolution mechanism).

Read More »

Read More »

FX Daily, December 1: No Follow-Through After Month-End Adjustments

The near-record rallies seen in the major equity markets in November may have contributed to the month-end drama yesterday. There has been no follow-through activity. Stocks bounced back, and the US dollar is heavy, with few exceptions.

Read More »

Read More »

FX Daily, November 27: Dollar Offered Ahead of the Weekend

Equities are finishing the week on a firm tone, while the US dollar remains heavy. In the Asia Pacific, only Australia and India did not end the week on a firm note. The MSCI Asia Pacific completed its fourth consecutive weekly gain, for around a 13% gain.

Read More »

Read More »

FX Daily, November 25: Risk Appetites Stall Ahead of the US Thanksgiving Holiday

The global equity rally appears to be stalling after the US markets rallied strongly yesterday. Chinese, Taiwan, Korean, and Indian indices fell, and the MSCI Asia Pacific Index appears to have posted only its second loss this month. European shares are narrowly mixed, leaving the Dow Jones Stoxx 600 little changed.

Read More »

Read More »

FX Daily, November 24: Diverging PMIs Fail to Give the Dollar Lasting Support

Overview: The contrast between the eurozone and US preliminary PMI readings caught the short-term market leaning the wrong way, and the dollar snapped back after extending its recent losses. However, today the US dollar is back on its heels and returning to yesterday's lows against most major currencies.

Read More »

Read More »

FX Daily, November 20: US Treasury-Fed Dispute Spurs Handwringing but Immediate Market Impact was Exaggerated

Overview: News that the stimulus talks between the House Democrats and Senate Republicans was the excuse traders were looking for to extend the US equity gains yesterday, but shortly after the close, confirmation that Treasury was not going to agree to extend several Fed facilities sent stocks reeling.

Read More »

Read More »

FX Daily, November 19: Surging Virus Saps Risk Appetites

Overview: News that the New York City was closing the schools to contain the virus sent stocks reeling in late North American dealings yesterday and spurred some profit-taking in the Asia Pacific and Europe. Equities in the Asia Pacific region were mostly lower, though China, South Korea, and Australia's advanced and Tokyo markets were mixed.

Read More »

Read More »

FX Daily, November 18: Balancing Pandemic Surge with Optimism about Vaccine

News that Tokyo will go to its highest alert as it faces a rising contagion snapped a 12-day rally in the Nikkei, but most bourses in the Asia Pacific region excluding Japan advanced, though Chinese equities were mixed. European equities are narrowly mixed as the Dow Jones Stoxx 600 continues to gyrate within Monday's range.

Read More »

Read More »

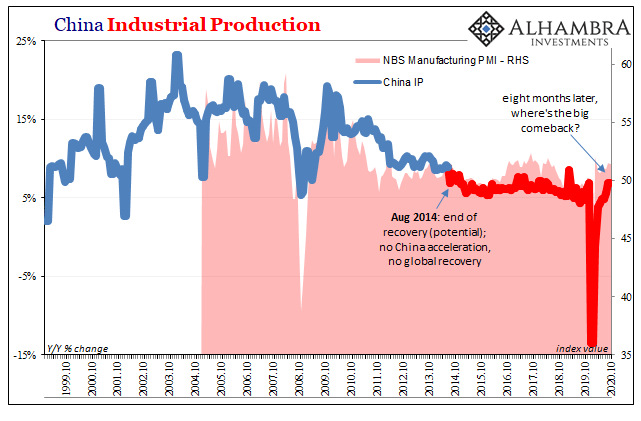

Six Point Nine Times Two Equals What It Had In Twenty Fourteen

It was a shock, total disbelief given how everyone, and I mean everyone, had penciled China in as the world’s go-to growth engine. If the global economy was ever going to get off the ground again following GFC1 more than a half a decade before, the Chinese had to get back to their precrisis “normal.”

Read More »

Read More »

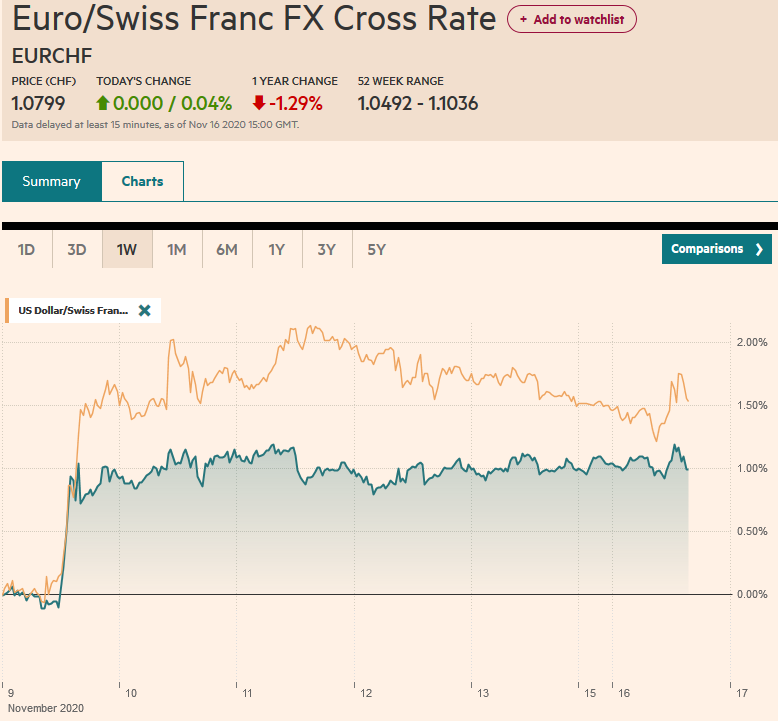

FX Daily, November 16: Risk-On Despite Surging Pandemic

Despite the surging pandemic and new restriction measure, risk-appetites appear strong to start the week. Led by 2% gains in the Nikkei and Taiwan's Taiex, all of the Asia Pacific region's equity markets advanced. European markets have followed suit and the Dow Jones Stoxx 600 is knocking on last week's eight-month high.

Read More »

Read More »

FX Daily, November 13: Greenback Pares this Week’s Gains while the Turkish Lira Continues to Squeeze Higher

Overview: The largest bourses in the Asia Pacific region followed the US equity market lower, with the Nikkei posting its first loss in nine sessions. China, Hong Kong, and Australia moved lower as well. On the week, the MSCI Asia Pacific Index gained about 1% after rising 6.3% in the prior week.

Read More »

Read More »

FX Daily, November 12: Nervous Calm in the Capital Markets

There is a nervous calm in the capital markets today. The equity rally in the Asia Pacific region stalled to end an eight-day rally, though the Nikkei's rally remains intact.

Read More »

Read More »