Tag Archive: China

Market Economy Beats Planned Economy

Throughout the next weeks, we will regularly feature the keynote speeches held by our distinguished experts at this year’s digital Free Market Road Show. The times we are living in – the pandemic – are times when our fundamental values are threatened maybe more than ever in modern times.

Read More »

Read More »

Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion.

Read More »

Read More »

More About Less New Orders

The inventory saga, planetary in its reach. As you’ve heard, American demand for goods supercharged by the federal government’s helicopter combined with a much more limited capacity to rebound in the logistics of the goods economy left a nightmare for supply chains. As we’ve been writing lately, a highly unusual maybe unprecedented inventory cycle resulted (creating “inflation”).

Read More »

Read More »

Hard to Be Sterling

Overview: Energy prices pulled back late yesterday, but it offered little reprieve to the bond market where the 10-year benchmark yields in the US, UK, Sweden, and Switzerland reached new three-month highs. November WTI traded to almost $76.70 before reversing lower and leaving a potentially bearish shooting star candlestick in its wake.

Read More »

Read More »

Soaring Energy Prices Lift Yields, Weigh on Equities and the Greenback Pops

Overview: Rising energy prices and yields are helping lift the US dollar and weighing on equities. November WTI has pushed above $76, while Brent traded above $80, and natural gas is up for the fourth consecutive session, during which time it has risen by about 25%.

Read More »

Read More »

Weekly Market Pulse: Not So Evergrande

US stocks sold off last Monday due to fears over the potential – likely – failure of China Evergrande, a real estate developer that has suddenly discovered the perils of leverage. Well that and the perils of being in an industry not currently favored by Xi Jinping. He has declared that houses are for living in not speculating on and ordered the state controlled banks to lend accordingly.

Read More »

Read More »

Taper, No Tantrum

Overview: The market's reaction to the FOMC statement was going according to our script, with the dollar backing off on a buy rumor sell the fact type of activity until Powell provided an end date for the tapering (mid-2022) before providing a start date (maybe next month). This spurred a dollar rally.

Read More »

Read More »

What to Expect When You are Expecting

Overview: The markets have stabilized since Monday's panic attack but have not made much headway. China and Taiwan returned from the extended holiday weekend. Mainland shares were mixed. Shanghai rose by about 0.4%, while Shenzhen fell by around 0.25%.

Read More »

Read More »

Ever Grand

Overview: Coming into yesterday's session, the S&P 500 had fallen in eight of the past ten sessions. It closed on its lows before the weekend and gapped. Nearly the stories in the press blamed China and the likely failure of one of its largest property developers, Evergrande.

Read More »

Read More »

Risk Appetites Didn’t Return from the Weekend

Overview: Investors' mood did not improve over the weekend, and the lack of risk appetites are rippling through the capital markets today. Equities have tumbled, yields have backed off, and the dollar is well bid. Hong Kong and Australia led the sell-off in the Asia Pacific region, off 3.3% and 2.1%, respectively.

Read More »

Read More »

FX Daily, September 15: China Disappoints, but the Yuan Remains Strong

The sixth decline of the S&P 500 in the past seven sessions set a negative tone for equity trading in the Asia Pacific region, and the poor Chinese data did not help matters. News that China's troubled Evergrande would miss next week's interest payment weighed on sentiment too.

Read More »

Read More »

Is it Really all about US CPI?

Overview: The markets are in a wait-and-see mode, it appears, ahead of the US CPI figures, as it absorbs bond supply from Europe and monitors the potential restructuring of China's Evergrande. A new storm may hit US oil and gas in the Gulf before recovering from the past storm and helping to underpin prices.

Read More »

Read More »

How (Not) to Win Friends and Influence People

Overview: There are two big themes in the capital markets today. The first is the ongoing push of the Chinese state into what was the private sector. Today's actions involve breaking Ant's lending arms into separate entities, with the state taking a stake. This weighed on Chinese shares and Hong Kong, where many are lists. On the other hand, Japanese markets extended their recent gains.

Read More »

Read More »

Don’t Make a Fetish Out of What may be a Minor Change in the Pace of ECB Bond Buying

Overview: Yesterday's retreat in US indices was part of and helped further this bout of profit-taking. The MSCI Asia Pacific Index ended an eight-day advance yesterday and fell further today. Japanese indices, which had set multiyear highs, fell for the first time in nine sessions. Hong Kong led the regional slide with a 2.3% decline as China's crackdown on the gaming industry continued.

Read More »

Read More »

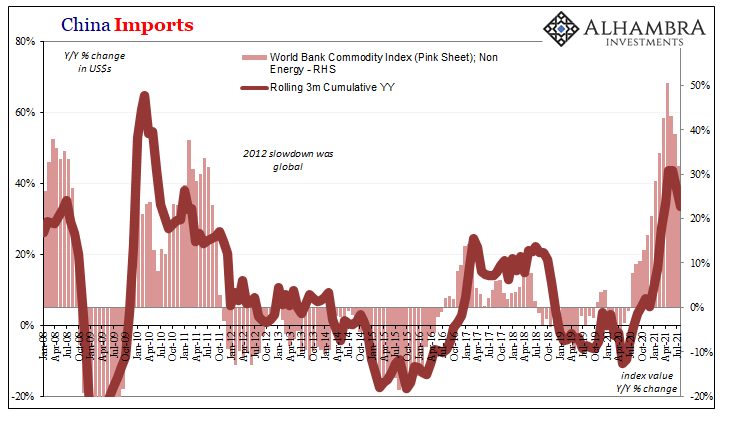

What’s Real Behind Commodities

Inflation is sustained monetary debasement – money printing, if you prefer – that wrecks consumer prices. It is the other of the evil monetary diseases, the one which is far more visible therefore visceral to the consumers pounded by spiraling costs of bare living. Yet, it is the lesser evil by comparison to deflation which insidiously destroys the labor market from the inside out.

Read More »

Read More »

FX Daily, August 17: Antipodeans and Sterling Bear Brunt of Greenback’s Gains

Overview: Concern about the economic impact of the virus and new efforts by China to curb "unfair" competition among online companies has triggered a dramatic response by investors. A lockdown in New Zealand and the Reserve Bank of Australia signaling it will respond if the economic fallout increases sent the Antipodean currencies sharply lower.

Read More »

Read More »

Markets Look for Direction, Currencies in Narrow Ranges

Overview: The global capital markets are subdued today as investors wrestle with the rising virus, the shifting stance of several central banks, and a more tense geopolitical backdrop. Equity markets are struggling today.

Read More »

Read More »

Rising Rates Underpin the Greenback

Overview: The US dollar remains firm ahead of the July CPI release, and even though Chicago Fed Evans demurred from the hawkish talk, the market is getting more comfortable with the idea of a rate hike next year.

Read More »

Read More »

Gold’s Flash Crash and Limited Follow-Through Greenback Gains

Overview: A flash crash saw gold drop more than $70 an ounce in early Asia. Silver was dragged lower too. The precious metals have stabilized at lower levels, but it signals a rough adjustment to a higher interest rate environment as a hawkish BOE and strong US employment data suggest peak monetary stimulus is at hand.

Read More »

Read More »

Yesterday’s Dollar Recovery Stalls

Overview: US interest rates and the dollar turned higher following comments by the Fed's Vice Chairman Clarida, who appeared to throw his lot with the more hawkish members. The dollar recovered from weakness that had seen it fall to almost JPY108.70, its lowest level since late May, and lifted the euro to $1.19.

Read More »

Read More »