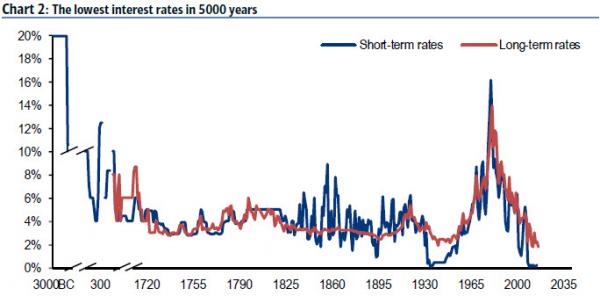

Most recently the Bundesbank critised the ECB decision to reduce Italian yields contained in the OMT program. To put things into perspective:

Germany paid 5% interest for 10 years government bonds between 1996 and 2002.

This at average inflation-adjusted GDP growth rates of 0.5%.

But there was no ECB that was buying German bonds during that period, there was nobody that helped to finance the costs of the German reunification except the Germans themselves.

Instead the German government decided to stop deficit spending and to implement austerity in 1997. Germany became the “sick man of Europe” and the German balance sheet recession started.

| Year | German government gross debt | Percent Change |

|---|---|---|

| 1991 | 39.537 | |

| 1992 | 42.019 | 6.28 % |

| 1993 | 45.767 | 8.92 % |

| 1994 | 47.968 | 4.81 % |

| 1995 | 55.597 | 15.90 % |

| 1996 | 58.467 | 5.16 % |

| 1997 | 59.754 | 2.20 % |

| 1998 | 60.491 | 1.23 % |

| 1999 | 61.257 | 1.27 % |

| 2000 | 60.182 | -1.75 % |

| 2001 | 59.142 | -1.73 % |

| 2002 | 60.748 | 2.72 % |

| 2003 | 64.426 | 6.05 % |

| 2004 | 66.204 | 2.76 % |

| 2005 | 68.514 | 3.49 % (source) |

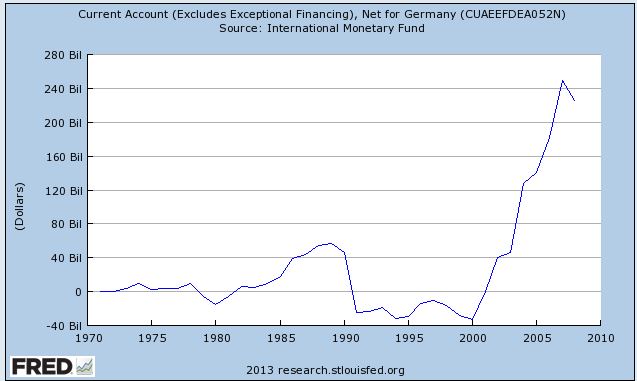

Thanks to generous deficit spending of the rest of Europe, cheap labor from Eastern Germany, low or no wage and increased productivity helped so that the German current account surplus exploded.

One can understand that the Bundesbank declares ‘war’ on Mario Draghi bond bail-out at Germany’s top court, because the ECB manipulates market prices. According to the Bundesbank a potential euro exit of a debtor nation makes the ECB and behind her Germans reliable.

At the end it was the German reunification that made the euro zone possible, because due to its high costs, Germany was a weak economy under many other weak ones.

Why should the European periphery not be able to repeat the German success story?

Tags: austerity,Bond yield,public debt