Minsky’s financial instability hypothesis

Hyman Minsky‘s financial instability hypothesis is related to theories of economists like Walter Bagehot and Charles Kindleberger and the Austrian economists. Minsky introduced an Austrian-economics like “Boom and Bust Cyle” caused by excesses in the financial sector. Minsky’s cycle consists of

- displacement

- boom

- euphoria

- profit taking

- and panic.

Already in February 2008 New Yorker titled “The Minsky Moment” by John Cassidy. In his commentary Cassidy wrote an excellent introduction about Hyman P. Minsky and similarly he foresaw the rest of the Financial Crisis:

Soon after the financial crisis papers titled “We are all Minskyites now”. After Quantitative Easing and other Keynesian ideas could not bring relieve, but a new wave of slow growth arrived, Minsky re-appeared more strongly in 2012. After Brad DeLong’s post “The Perils of Prophecy” in June 2012 Economonitor questioned DeLong’s arguments in “We are Minskians now“.

Was Minsky a Post Keynesian or rather an Austrian ?

Many people claim ([King 2002] or here) claim that Minsky was one, however Minsky himself does not want to be named Post Keynesian. Minsky himself wrote about Post Keynesians.

Charles Kindleberger : The world in depression 1929-1939

(New Preface, by Brad DeLong, Barry Eichengreen, online on Vox)

First, panic. Kindleberger argued that panic, defined as sudden overwhelming fear giving rise to extreme behaviour on the part of the affected, is intrinsic in the operation of financial markets. In The World in Depression he gave the best ever “explain-and-illustrate-with-examples” answer to the question of how and why panic occurs and financial markets fall apart. Kindleberger was an early apostate from the efficient-markets school of thought that markets not just get it right but also that they are intrinsically stable. His rival in attempting to explain the Great Depression, Milton Friedman, had famously argued that speculation in financial markets can’t be destabilising because if destabilising speculators drive asset values away from justified, or equilibrium, levels, such speculators will lose money and eventually be driven out of the market.3 Kindleberger pushed back by observing that markets can continue to get it wrong for a very, very long time. He girded his position by elaborating and applying the work of Minsky, who had argued that markets pass through cycles characterised first by self-reinforcing boom, next by crash, then by panic, and finally by revulsion and depression. Kindleberger documented the ability of what is now sometimes referred to as the Minsky-Kindleberger framework to explain the behaviour of markets in the late 1920s and early 1930s – behaviour about which economists otherwise might have arguably had little of relevance or value to say. The Minsky paradigm emphasising the possibility of self-reinforcing booms and busts is the organising framework of The World in Depression. It then comes to the fore in all its explicit glory in Kindleberger’s subsequent book and summary statement of the approach,Mania, Panics and Crashes.

Kindleberger’s second key lesson, closely related, is the power of contagion. At the centre of The World in Depression is the 1931 financial crisis, arguably the event that turned an already serious recession into the most severe downturn and economic catastrophe of the 20th century. The 1931 crisis began, as Kindleberger observes, in a relatively minor European financial centre, Vienna, but when left untreated leapfrogged first to Berlin and then, with even graver consequences, to London and New York. This is the 20th century’s most dramatic reminder of quickly how financial crises can metastasise almost instantaneously. In 1931 they spread through a number of different channels. German banks held deposits in Vienna. Merchant banks in London had extended credits to German banks and firms to help finance the country’s foreign trade. In addition to financial links, there were psychological links: as soon as a big bank went down in Vienna, investors, having no way to know for sure, began to fear that similar problems might be lurking in the banking systems of other European countries and the US. In the same way that problems in a small country, Greece, could threaten the entire European System in 2012, problems in a small country, Austria, could constitute a lethal threat to the entire global financial system in 1931 in the absence of effective action to prevent them from spreading.This brings us to Kindleberger’s third lesson, which has to do with the importance of hegemony, defined as a preponderance of influence and power over others, in this case over other nation states. Kindleberger argued that at the root of Europe’s and the world’s problems in the 1920s and 1930s was the absence of a benevolent hegemon: a dominant economic power able and willing to take the interests of smaller powers and the operation of the larger international system into account by stabilising the flow of spending through the global or at least the North Atlantic economy, and doing so by acting as a lender and consumer of last resort. Great Britain, now but a middle power in relative economic decline, no longer possessed the resources commensurate with the job. The rising power, the US, did not yet realise that the maintenance of economic stability required it to assume this role. In contrast to the period before 1914, when Britain acted as hegemon, or after 1945, when the US did so, there was no one to stabilise the unstable economy. Europe, the world economy’s chokepoint, was rendered rudderless, unstable, and crisis- and depression-prone. That is Kindleberger’s World in Depression in a nutshell. As he put it in 1973:

“The 1929 depression was so wide, so deep and so long because the international economic system was rendered unstable by British inability and United States unwillingness to assume responsibility for stabilising it in three particulars:

(a) maintaining a relatively open market for distress goods;

(b) providing counter-cyclical long-term lending; and

(c) discounting in crisis….

The world economic system was unstable unless some country stabilised it, as Britain had done in the nineteenth century and up to 1913. In 1929, the British couldn’t and the United States wouldn’t. When every country turned to protect its national private interest, the world public interest went down the drain, and with it the private interests of all…”3 Friedman’s great work on the Depression, coauthored with Anna Jacobson Schwartz (1963), was in Kindleberger’s view too monocausal, focusing on the role of monetary policy, and too U.S. centric. See also Friedman (1953)

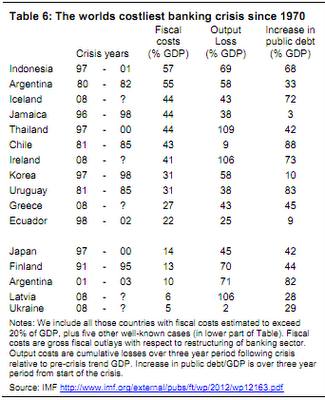

The costliest Banking Crises

A MINSKY-KINDLEBERGER PERSPECTIVE ON THE FINANCIAL CRISIS

by J. Barkley Rosser, Jr., Marina V. Rosser (both James Madison University), Mauro Gallegati, online)

Abstract:

Hyman Minsky and Charles Kindleberger discussed three different patterns of speculative bubbles. One is when price rises in an accelerating way and then crashes very sharply after reaching its peak. Another is when price rises and is followed by a more a similar decline after reaching its peak. The third is when price rises to a peak, which is then followed by a period of gradual decline known as the period of financial distress, to be followed by a much sharper crash at some later time. All three patterns occurred during the financial crisis of 2008-09. Oil prices during 2008 showed the first pattern (peaking in July, 2008); housing prices over nearly a decade showed the second (peaking in 2006), and stock markets showed the third pattern (peaking in October, 2007). Policy directed at containing such bubbles should not use overly broad tools such as general monetary policy, but should be crafted to aim at specific bubbles. Whereas buffer stocks may be useful for commodity bubbles, limits on leverage or taxes on transactions may be more useful for financial markets.

The three types of speculative bubbles are most clearly laid out in Charles Kindleberger’s Manias, Panics, and Crashes (1978, 2000), with the first explanation of the most widespread third type based on work of Hyman Minsky (1972, 1982), whose discussion more generally underpinned Kindleberger’s discussion of the nature and pattern of how speculative bubbles develop and end. Minsky laid out a general framework, and Kindleberger supplied numerous historical examples to fill out this general framework, with the subsequent editions of his book expanding this set of examples and providing yet more supporting details for the more general story.

The first is that most commonly found in theoretical literature on speculative bubbles and crashes (Blanchard and Watson, 1982; DeLong et al, 1990). In this pattern prices rise rapidly, usually at an accelerating rate in most of the theoretical literature, then to drop very sharply back to a presumed fundamental level after reaching the peak. The general argument is that speculative bubbles are self-fulfilling prophecies. Price rises because agents expect it to do so, with this ongoing expectation providing the increasing demand that keeps the price rising. If due to some exogenous shock the price stops rising, this breaks the expectation, and the speculative demand suddenly disappears, sending the price back to its fundamental (or thereabouts) very rapidly where there is no expectation of the price rising. In the case of the stochastically crashing rational bubble model of Blanchard and Watson, the price rises at an accelerating rate. This occurs because as it rises the probability of a crash rises, and the rational agents require an ever rising risk premium to cover for this rising probability of crash.[i]

In the second type the price rises, reaches a peak that may last for awhile, and then declines again, sometimes at about the same rate as it went up. There is no crash as such, in contrast with other types of bubbles in which there is a period when the price declines much more rapidly than it ever rose, often characterized by panic among agents as described by both Minsky and Kindleberger. In this type of bubble, many agents may be quite unhappy as the price declines, but there is no general panic. Some might argue that such a pattern is not really a bubble in that how one truly identifies a bubble is precisely by the occurrence of a dramatic crash of price. However, in this case one observes a price that appears to be above the fundamental and then moves back down towards that fundamental.[ii]

The main problem then becomes whether or not one can define or observe such a fundamental, which is particularly difficult for assets that do not generate an income stream, such as many collectible items. Indeed, some have argued that all attempts to identify fundamentals face the problem of the misspecified fundamental, that what an econometrician or other observer may think is the fundamental is not what agents in the market think is the fundamental, which cannot be determined for sure.[iii]

The third type of bubble is that which exhibits a period of financial distress, a type first identified and labeled by Minsky (1972). In this the price rises to a peak that is followed initially by a gradual decline for awhile, but then there is a panic and crash. According to Kindleberger (1978, 2000, Appendix B), this is by far the most common type of bubble, with most of the larger and more famous historical ones conforming to its pattern, including among others the Mississippi bubble of 1719, the South Sea bubble of 1720, the US stock market bubble of 1928-29, and the same which crashed in 1987, even as this has been the least studied of bubble types. What is involved is heterogeneous behavior by agents, with some insiders getting out at the peak while others hang on during the period of financial distress until the panic and crash.

[i] Jiang et al (2010) combine such an approach with a pattern of accelerating oscillations in their log-periodic power law model that has managed to forecast quite closely the peaks of some Chinese stock market bubbles.

[ii] More generally there is much disagreement regarding the definition of what a bubble is. While the most common definition is of a price remaining above a fundamental value for some extended period, at least one difficulty is that some may argue that there is not even a fundamental at all, with some Post Keynesians and econophysicists making this point. There are also arguments over whether prices that do not change much can be considered to be stationary bubbles or not bubbles at all.

[iii] One case where a fundamental may well be pretty well defined is that of closed-end funds, which consists of a set of assets that have a net asset value that may differ from the value of the fund. Generally, the net asset value will be the fundamental, adjusted for tax or transactions costs, so they can be identified as possessing clear premia or discounts (Ahmed et al, 1997).

Blanchard, Olivier J., Mark W. Watson. “Bubbles, Rational Expectations, and Financial Markets.” In Crises in the Economic and Financial Structure, edited by P. Wachtel, 295-315. Lexington: Lexington Books, 1982 (Blanchard and Watson, 1982).

DeLong, J. Bradford, Andrei Shleifer, Lawrence H. Summers, Robert J. Waldman. “Positive Feedback Investment Strategies and Destabilizing Rational Speculation.” Journal of Finance 45, 2 (1990): 379-395 (DeLong et al, 1990).

Friedman, Milton (1953), “The Case for Flexible Exchange Rates”, in Essays in Positive Economics, University of Chicago Press.

Friedman, Milton and Anna J Schwartz (1963), A Monetary History of the United States, 1967-1960, Princeton University Press.

Gilpin, Robert (1987), The Political Economy of International Relations, Princeton University Press.

Keohane, Robert (1984), After Hegemony, Princeton University Press.

King, J. E. 2002. A History of Post-Keynesian Economics since 1936, Edward Elgar, Chelten.

Kindleberger, Charles P. Manias, Panics, and Crashes: A History of Financial Crisis, 1st edition. New York: Basic Books, 1978 (Kindleberger, 1978).

Kindleberger, Charles P. Manias, Panics, and Crashes: A History of Financial Crisis, 4th edition. New York: John Wiley & Sons, 2000 (Kindleberger, 2000).

Krugman, Paul (2003), “Remembering Rudi Dornbusch”, unpublished manuscript,www.pkarchive.org, 28 July.

Lake, David (1993), “Leadership, Hegemony and the International Economy: Naked Emperor or Tattered Monarch with Potential?”, International Studies Quarterly, 37: 459-489.

Martin, Wolf, and Summers, Lawrence (2011), “Larry Summers and Martin Wolf: Keynote at INET’s Bretton Woods Conference 2011”, online on youtube.com, Institute for New Economic Thinking, 9 April.

Minsky, Hyman P. “Financial Instability Revisited: The Economics of Disaster.” Reappraisal of the Federal Reserve Discount Mechanism 3 (1972): 97-136 (Minsky, 1972).

Minsky, Hyman P. “The Financial Instability Hypothesis: Capitalistic Processes and the Behavior of the Economy.” In Financial Crises: Theory, History, and Policy, edited by Charles P. Kindleberger, Jean-Paul Laffargue, 12-29. Cambridge: Cambridge University Press, 1982 (Minsky, 1982).

Rosser, J. Barkley, Rosser, Marina V., Gallegati, Mauro, A MINSKY-KINDLEBERGER PERSPECTIVE ON THE FINANCIAL CRISIS, James Madison University

Shiller, Robert J. Irrational Exuberance, 2nd edition. Princeton: Princeton University Press, 2005 (Shiller, 2005).

The New Yorker, John Cassidy, “The Minsky Moment”, Last Retrieved 2012, October, 16

See more for

2 comments

J. Hume

2016-03-02 at 14:06 (UTC 2) Link to this comment

Minsky not a post-Keynsian but an Austrian ? In the paper you cite ( http://digitalcommons.bard.edu/hm_archive/336/ ) Minsky offers a critique of the so-called New-Keynsian synthesis … but he sympathetic to Post-Keynsian defence of Keynes! There’s a big difference. More recently, Keen has developed a mathematical formulation of Minsky’s insight that there is a non-linearity INTRINSIC to capitalism … not an Austrian Boom-Bust cycle !!!

George Dorgan

2016-03-23 at 18:42 (UTC 2) Link to this comment

Thank you for this input.

Minsky can be assumed Austrian because in this way he speaks about the Austrian boom-bust cycles caused by excessive credit.